How can we help?

Select an option on the left to see how we can help.

Meet our field leaders to help guide you, and find out more about our rewards and recognition programs.

- Gain clarity on what you want to build and how you define success

- Design a strategic plan that capitalizes on your strengths

- Execute with an accountability partner who helps you stay the course

Meet our practice development team to help or refine your business plan.

Access 1-on-1 coaching and a comprehensive marketing suite to build your website, email, and social media presence. Meet our marketing team to help you focus on client acquisition and retention.

Meet our product team and sales desk to help you present the right products and platforms prospects and clients.

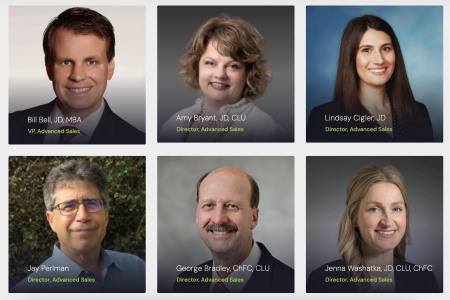

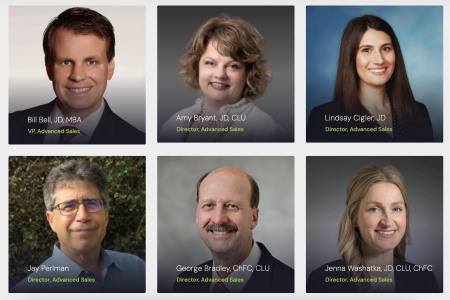

Meet our advanced sales team to help you focus on diving into financial planning, business owner planning, retirement planning and estate planning.

Investigate our proprietary Strategic Business Solutions program.

Explore options for whole life / universal life and term life products for both individuals and survivorship and amazing dividend history

Explore our proprietary Professional Alliance Advantage program designed to enable partnerships through unlicensed or licensed CPAs and P&C attorneys.

Explore the platforms, programs and technology for our fee-based planners/holistic planners

Explore your options for brokerage, advisory, and retirement account platforms and products for our registered representatives and IARs

Explore options for whole life / universal life and term life products for both individuals and survivorship and amazing dividend history

Explore options for whole life / universal life and term life products for both individuals and survivorship and amazing dividend history

Explore our variable, fixed, indexed and immediate annuity options to meet any income and time horizon goal.

Explore the platforms, programs and technology for wealth managers to go beyond financial planning and into services like investment management, business owner planning, estate planning and legacy planning.

Avoid any family issues or concerns such as buy/sell agreements with children that want to carry forward your legacy vs. children who do not want to be a part of your practice. Let our practice development team guide you through your options.

Formalize your succession plan with business partners, including continuity agreements, succession agreements, practice valuation and buy/sell agreements potentially funded by insurance policies. Let our practice development team guide you through your options.

Determine if your continuity / contingency plan would benefit from becoming a full succession plan, or if you need to do more work to find your true successor. Let our practice development team guide you through your options.

Form a continuity or succession plan, as well as entertain offers from our ‘practice buyers’ database’ when the time comes to sell. Let our practice development team guide you through your options.

Seriously?

Check another option please. It may seem hard but we’re here to help you with an informal / formal continuity and succession plan.

Meet our compliance and supervision team, and even consider a complimentary call / confidential discussion about your business plan, marketing plan, advertising materials and ongoing marketing needs before you join.

Work with one of our field leaders to help you understand our rewards and recognition programs and our overall compensation

- Cash bonus plan

- Whole life persistency bonus

- 401(k) with company match

- Retirement plan with company contribution

- Non-qualified deferred comp up to 50% of your current comp

Compensation, bonuses and benefits vary. Exclusions or limitations may apply. Contact 1847Financial to learn more.

Don't work in a silo.

With our practice development and marketing teams, you have a dedicated coach who will help you reach your goals.

83% of advisors agree that better technology will improve client acquisition. 1

Explore Ace, Insight, Gateway and our wealth management tools like NetX360, Envestnet, Morningstar, WealthView, Fi360, AdvicePay, FMG Marketing Suite, and our full list of recommended tools.

1 ThinkAdvisor

Request a virtual or in-person home office visit and we’ll let you meet with every team you’d engage with that is essential to your practice.

We offer a wide variety of options for professional development.

- Wealth Management University

- Immersion training for new FPs (quarterly)

- Firm-level training

- Robust training calendar

- 30-minute Thursdays

- Field development day

Talk with us about:

- Cash bonus plan

- Whole life persistency bonus

- 401(k) with company match

- Retirement plan with company contribution

- Non-qualified deferred comp up to 50% of your current comp